Loyalty programs are designed for continuous participation from members.

But if you’re a loyalty program manager responsible for generating program ROI, it’s not enough to simply understand where you are — you need to know where you’re going.

Unless you have a crystal ball, however, you’re likely going to need some help. But where should you start?

The answer is predictive modeling. Predictive modeling, which uses statistics to predict future outcomes, helps program managers determine the value each loyalty program member will bring to a company. Unfortunately, accurately forecasting the right numbers is easier said than done.

That’s where actuaries come in.

While their title may not be the most glamorous, actuaries are the financial experts who can shed light on the future of your loyalty program.

How exactly? By forecasting and extrapolating off past and current data, often with great accuracy. In fact, employing actuarial insights is one of the best ways to prepare your program for long-term financial success.

Actuaries can help you answer important questions such as:

“How can I optimize member acquisition?”

“Who are my highest value members?”

“Is my program strategy driving incremental value?”

When you arm yourself with an actuary, you’re taking an essential step towards setting and achieving your loyalty program goals.

In this piece, we’ll explain:

- What actuaries actually do

- 9 reasons why actuarial insight is useful to your loyalty program

- Why a data science team isn’t enough

- What you should look for in a loyalty program actuary

Do you know where your program is heading and why? Let’s enter the world of actuarial insight.

What does an actuary actually do?

To those new to the world of actuarial consulting, actuaries are somewhat of an enigma.

The Society of Actuaries labels the profession as “Part super-hero. Part fortune-teller. Part trusted advisor.” While you probably won’t encounter an actuary with a cape, these professionals take on an essential role in accounting for loyalty programs: they manage loyalty program risk by planning for the future and protecting their organization against loss.

Actuaries are generally associated with the insurance industry

Most people associate actuaries with insurance, and they’re right: over 50% of actuaries are employed directly or indirectly by the insurance industry.

Insurance companies are in the business of predicting outcomes. These companies are required to reserve cash for the policies that they sell, and must set aside money for the claims they expect to eventually pay out on those policies. Given the range of insurance policies, this planning can take on many different forms.

For example, when an insurance company issues your car insurance policy, they have to estimate the probability of paying a claim, the size of that claim, and the timing of when it will occur.

You pay your policy annually. And maybe someday (hopefully not), you’ll need to draw on your insurance policy to cover the costs of an accident or damage to your vehicle. The insurance company has to ensure, on average, customers are paying more into the plan than the company is doling out. It’s how they stay in business while still providing uninterrupted coverage.

Another example is workers' compensation insurance. Some claims may not be reported until many years later (such as a disease brought about by occupational conditions), but would require medical payments throughout the rest of a person’s life.

While auto insurance claims only involve predictions over the twelve months of the policy period, reserving for worker compensation requires the tools to predict expected claims payments decades into the future based on the information available today.

When it comes to your loyalty program, this is just the type of information you need.

Actuaries have the toolbox for making long-term predictions

Fortune-tellers have crystal balls; actuaries have numbers, data, and statistics. Using statistical analysis, they can evaluate the probability of future events occurring and plan accordingly.

In the context of loyalty programs, cash flow (amount, timing) is the primary metric examined. Other metrics can include:

- Customer lifetime value (CLV)

- Customer future value (CFV)

- Customer potential value (CPV)

- Ultimate redemption rate (URR)

- Cost-per-point (CPP)

- Breakage

Forecasting over the long term is required for insurance companies, and can be highly beneficial for loyalty programs. Let’s walk through the benefits to long-term forecasting with actuaries.

9 reasons why actuarial insight is useful for loyalty programs

1. Helps predict loyalty program liability

When points are issued, companies must defer revenue for the eventual cost of redemption. This is required by the financial reporting standards ASC 606/IFRS 15. The challenge in estimating liability, however, lies in the number of variables associated with estimating redemption costs.

Actuaries can predict what percentage of points will ultimately be redeemed, when those redemptions will occur, and how much those redemptions will cost the company. After all, points can be redeemed many years (potentially decades) after they are earned. The best estimates require long-term forecasts.

Adding to this challenge is the reality that loyalty programs are dynamic, constantly evolving entities:

- Members change their behavior frequently

- Members are becoming increasingly sophisticated thanks to the availability of online resources on loyalty programs

- Programs frequently offer deals and marketing campaigns

- Programs occasionally change program structure – e.g., expiration rules, award charts, accrual charts, etc.

Liabilities can be very large, in the hundreds of millions or even billions of dollars – particularly among frequent flyer and hospitality programs. At this scale, CFOs and auditors require proper due diligence to validate liability estimates. Actuarial opinions provide formal documentation from a credentialed actuary stating their professional opinion on the booked program liability. This provides CFO, auditors, and other stakeholders proof of the due diligence.

2. Quantifies customer lifetime value (CLV)

While liability is important, the whole point of a loyalty program is to increase customer brand loyalty. (i.e., customers should keep coming back to your company to make purchases). The best way to quantify the value of this long-term loyalty is a metric known as customer lifetime value (CLV). CLV predicts the profits that a given member is expected to generate over his lifetime in the program.

As we’ve discussed in previous articles, CLV and its family of metrics are the most important KPIs to link program management to economic value creation. In fact, you can even use these metrics to proactively create economic value (you can review how to calculate customer lifetime value here).

Properly calculating CLV is critical to loyalty program profitability and requires the ability to predict over long horizons. As you’ll see, CLV and its many applications will unify the rest of this section.

3. Identifies high value members

Simply put, members with high CLV are likely to spend more money with your company. Targeting them with special offers will make them feel appreciated and inspire even more purchases, maximizing the likelihood of unlocking their expected future profits.

4. Drives incremental value by targeting high potential members

With just a small nudge, high potential members will likely increase their program participation, and, as a result, their CLV. A well-executed, targeted incentive strategy can grow the future economic value of your loyalty program.

5. Targets at-risks members with decreasing CLV

On the flip side, loyalty programs can use CLV as a defensive strategy. By identifying leading indicators of declining participation, programs can be designed to proactively prevent loss of economic value.

6. Provides enhanced customer service based on CLV

CLV quantifies the value of each customer. This indispensable information enables customer service agents to focus their efforts and spend more time and energy on resolving issues for those members most valuable to the organization. Note that this doesn’t mean that members with a low CLV don’t matter; rather, it focuses efforts on providing services that will keep your most loyal customers happy.

7. Optimizes new member acquisition based on value rather than cost

Well-run loyalty programs can become an appreciating asset for any company. Examining CLV as a growth value metric ensures that every dollar spent on acquisition is spent in a way that maximizes economic value, rather than minimizing cost.

8. Optimizes program design

Actuaries conduct scenario testing to forecast the impact of various program changes on CLV. By quantifying how these changes impact CLV, program managers can identify and implement the changes that drive the most growth. This ensures that program structure changes are focused on maximizing economic value.

9. Aligns marketing and finance around a common set of KPIs to measure economic value creation

Miscommunication and lack of alignment leads to lost time in business. Aligning KPIs across organizations prevents organizational conflict. Using the shared language of CLV, organizations can increase the speed by which they make decisions — a competitive advantage in today’s fast paced world.

Why a data science team isn’t enough

In today’s digital world, data analysis is a highly sought after skill. Wherever there’s a large amount of data, data scientists are needed to plug and chug through significant statistical analyses, searching for patterns and identifying solutions.

At first glance, data scientists share many skills with actuaries. Both require business intelligence and data analysis skills. And the end result of data analysis and actuarial insight is a best-fit solution to an ambiguous problem.

However, these professions are not interchangeable.

Data scientists lack domain knowledge

Data scientists know how to build models to make predictions, but not necessarily predictions over long horizons, which is where actuaries excel. Actuaries are also subject to rigorous formal training and credentialing in their domain of focus – whether that be insurance, finance, investments, etc.

We can’t overstate the value of domain knowledge. Consider this example:

Suppose you need brain surgery. Are you going ask your family doctor to do the operation, or a trained brain surgeon? Both are very smart, both are trained in the medical profession, and both probably have the aptitude to do it. But only the brain surgeon has the training, experience, and specific domain knowledge required to do the job correctly.

Data scientists and actuaries are similar: both are smart, both are trained in applied statistics, and both have the aptitude to learn to predict over long horizons; but only actuaries have the explicit training, experience, and specific domain knowledge required to do the job right.

What makes an ideal loyalty program actuary?

Traditional actuarial models focus on making predictions in aggregate. But the value of CLV lies in its ability to make predictions at the individual member level.

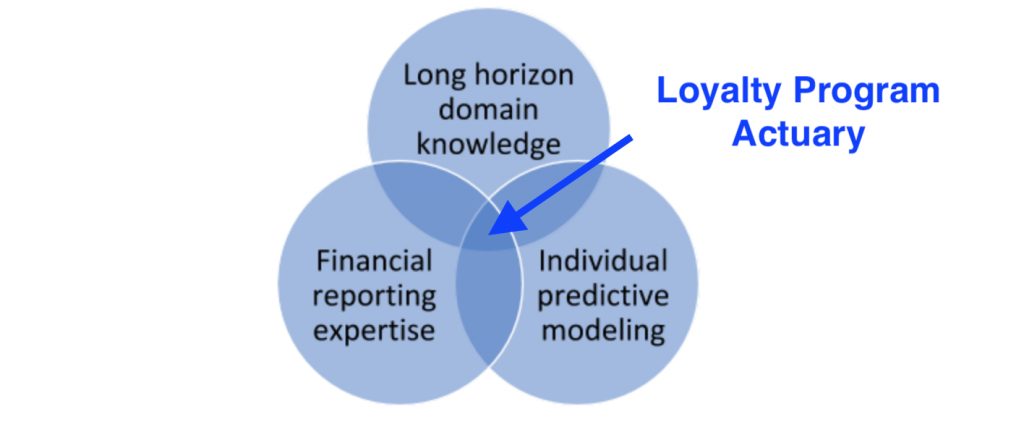

Within actuarial consulting there is even more niche domain knowledge required to properly apply actuarial theory to loyalty programs. The most effective professionals combine predictive modeling with expert financial reporting knowledge.

Individual predictive modeling

Loyalty program actuaries need to know how to leverage today’s technology to build predictive models. Traditional actuarial methods were developed decades ago, well before the availability of today’s big data and advanced predictive modeling capabilities.

While the basic actuarial concepts underlying traditional methods remain applicable to today’s loyalty programs, the methods themselves need to be redesigned to leverage modern technology and allow for individual member-level predictions. Therefore, you need an actuary with strong predictive modeling skills and experience using modern technology to solve problems.

Financial reporting expertise

Given a loyalty program’s complex financial reporting requirements, you not only need an actuary with predictive modeling skills, but also one with a strong understanding of the business dynamics and financial reporting regulations surrounding loyalty programs.

ASC 606/IFRS 15 have introduced updated revenue recognition standards and a fresh focus on loyalty program accounting practices. Your actuary needs to know how to properly identify performance obligations when accounting for loyalty programs.

In summary, the ideal loyalty program actuary is adept at predicting behavior over the long term, can build predictive models at the individual member level, and has a nuanced understanding of business dynamics and the financial reporting environment. This combination enables actuaries and loyalty program leaders to translate predictions into real business insight and loyalty program value.

Optimize your program with the right actuary

Loyalty programs generate more than a significant amount of data. Between engagement metrics, membership statistics and financial results, programs need someone with the skills to discern the meaning amidst all the noise. And while it’s easy enough to turn to any data scientist or actuary, to get the most actionable insight from your data, it’s best to trust those with deep domain expertise.

Imagine if each year at tax season, you hired an average accountant with limited personal tax experience. Would you really expect him or her to optimize your taxes and bring you the biggest refund?

The odds are that you would sleep better at night (and receive the biggest bang for your buck) if you hired a professional tax accountant with years of experience.

An ideal actuary can provide just as much peace of mind — and financial return — to your loyalty program. Select an expert who understands how to model your loyalty program liability, the nuances of customer lifetime value, and the fundamentals of optimizing program ROI.

Loyalty programs are one of the most effective ways of driving long-term customer value and ensuring the continued success of your business. When it comes to your program’s financial management, why cut corners?